Specialty Programs

Capabilities

Program business is generally defined as, ‘insurance products targeted to a particular niche market or industry class, representing a book of similar (homogeneous) risks or accounts.’

AF Specialty provides delegated underwriting authority programs to program administrators, managing general agents, association/industry trade groups, captives, reinsurance intermediaries and syndicates seeking a fronting facility to place well-managed, turnkey commercial property and casualty programs.

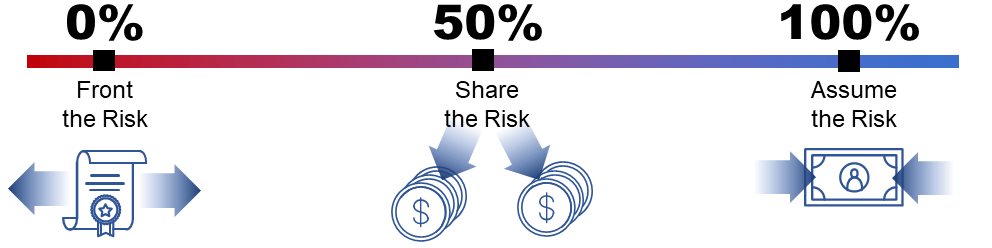

Spectrum of Risk

We don’t take a traditional approach; instead, we opt to view program opportunities across a spectrum of risk, which allows more flexibility for our partners to achieve their goals.

Fronting

Insurance fronting involves an insurer issuing a policy but transferring most or all of the risk to another entity, typically through reinsurance agreements. Insurance fronting helps businesses access insurance markets or comply with regulatory, rating, and/or contractual requirements. The fronting insurer typically charges a fee, often a percentage of the premium, for its role in policy issuance and administration.

Our fronting product provides eligible partners with multiple entities of admitted and non-admitted fronting paper that is rated “A” (Excellent) Financial Size Category: XIV by A.M. Best.

Risk Sharing

AF Specialty is distinguished from other fronting carriers by our ability to retain and share in a portion of the underwriting risk on select programs. We are comfortable establishing risk-sharing partnerships through a variety of platforms including captives and participation in reinsurance carrier panels.

Fully Insured Programs

Given our strong capitalization, AF Specialty is capable of providing full capacity to proven profitable programs. In a fully insured program, AF Group (throughout our family of brands) assumes all the underwriting risk. As with all program opportunities, AF Specialty engages in a thorough review of program’s historical profitability and supporting data.